The government announced a much-awaited economic package for MSMEs which has given a sigh of relief amid the economic slowdown due to Covid-19 crisis on 13th May, 2020. The relief package is expected to infuse fresh life into the country’s micro, small and medium enterprises (MSMEs), which account for almost 30 percent of the national GDP and is the backbone of Indian economy.

With a series of encouraging announcements, the Finance Minister outlined the government’s plan to raise the morale of the industry and the MSME sector in particular. Under the Atmanirbhar Bharat Abhiyan, several measures for MSMEs were announced that are expected to help 45 lakh business units resume their operations.

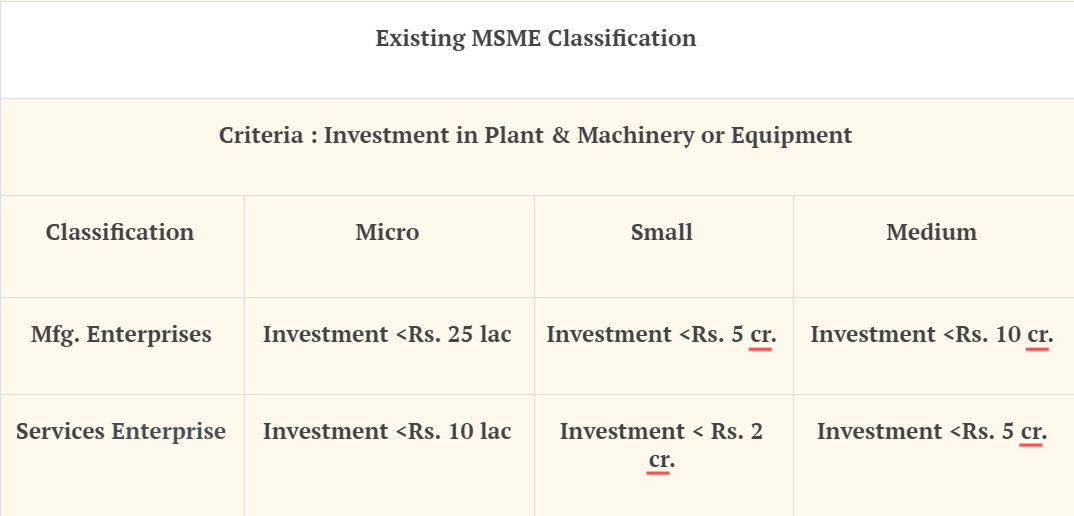

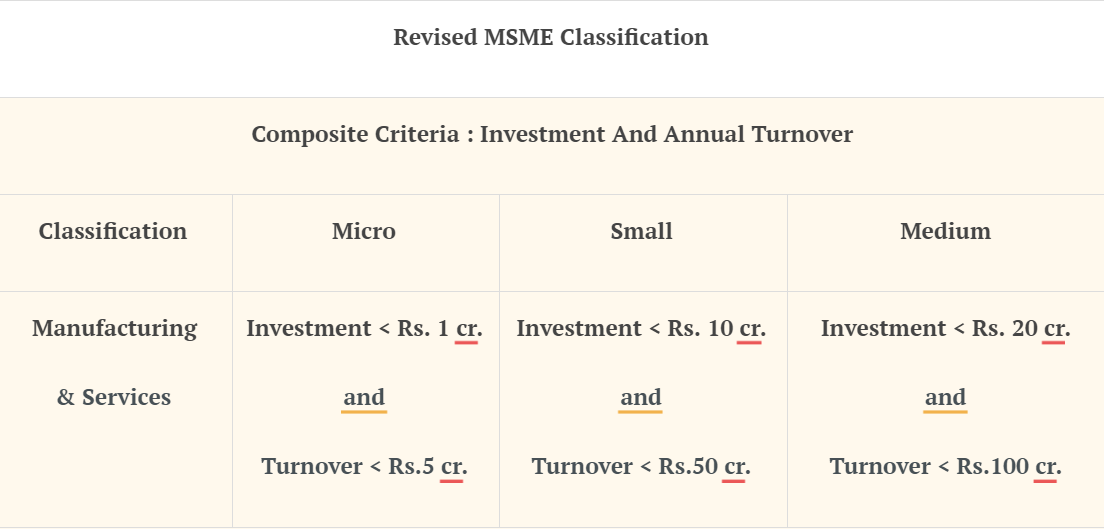

What is the definition of an MSME?

As per the ‘Atmanirbhar Bharat’ scheme announced

- Definition of MSMEs is revised

- Investment limit revised upwards

- Additional criteria of turnover also being introduced.

- The distinction between the manufacturing and service sector has been eliminated.

The change in definition will allow these units to expand and at the same time avail the benefits of MSME classification.

Reviewing the Old & New limits

The Benefits for MSMEs

Automatic Emergency Credit Line to Businesses/MSMEs from Banks and NBFCs up to 20% of entire outstanding credit as on 29.2.2020

- Borrowers with up to Rs. 25 crore outstanding and Rs. 100 crore turnover eligible

- Loans to have 4 year tenor with moratorium of 12 months on Principal repayment

- Interest to be capped

- 100% credit guarantee cover to Banks and NBFCs on principal and interest

- No guarantee fee, no fresh collateral

Rs 20,000 crores Subordinate Debt for Functioning MSMEs which are NPA or are stressed.

- Stressed MSMEs need equity support, GOI will facilitate provision of Rs. 20,000 cr as subordinate debt.

- Two lakh MSMEs are likely to benefit. Functioning MSMEs which are NPA or are stressed will be eligible

- Govt. will provide a support of Rs. 4,000 Cr. to CGTMSE

- CGTMSE will provide partial Credit Guarantee support to Banks

- Promoters of the MSME will be given debt by banks, which will then be infused by promoters as equity in the Unit.

Rs 20,000 crores Subordinate Debt for Functioning MSMEs which are NPA or are stressed.

- Stressed MSMEs need equity support, GOI will facilitate provision of Rs. 20,000 cr as subordinate debt.

- Two lakh MSMEs are likely to benefit. Functioning MSMEs which are NPA or are stressed will be eligible

- Govt. will provide a support of Rs. 4,000 Cr. to CGTMSE

- CGTMSE will provide partial Credit Guarantee support to Banks

- Promoters of the MSME will be given debt by banks, which will then be infused by promoters as equity in the Unit.

Rs 50,000 cr. Equity infusion for MSMEs through Fund of Funds

- MSMEs face severe shortage of Equity.

- Fund of Funds with corpus of Rs 10,000 crores will be set up.

- Will provide equity funding for MSMEs with growth potential and viability.

- FoF will be operated through a Mother Fund and few daughter funds

- Fund structure will help leverage Rs 50,000 cr of funds at daughter funds level.

- Will help to expand MSME size as well as capacity.

- Will encourage MSMEs to get listed on the main board of Stock Exchanges.

Global tenders will be disallowed in Government procurement tenders upto Rs 200 crores.

- Indian MSMEs and other companies have often faced unfair competition from foreign companies.

- Therefore, Global tenders will be disallowed in Government procurement tenders upto Rs 200 crores

- Necessary amendments of General Financial Rules will be effected.

- This will also help MSMEs to increase their business.

Rs 45,000 crore Partial Credit Guarantee Scheme 2.0 for NBFCs

- NBFCs, HFCs and MFIs with low credit rating require liquidity to do fresh lending to MSMEs and individuals.

- Existing PCGS scheme to be extended to cover borrowings such as primary issuance of Bonds/ CPs (liability side of balance sheets) of such entities.

- First 20% of loss will be borne by the Guarantor ie., Government of India.

- This scheme will result in liquidity of Rs 45,000 crores.

Clearing of dues: While announcing the credit guarantee for MSMEs, the Finance Minister assured that the Centre would clear pending MSME dues in 45 days. As on March 31, 2020, the total outstanding payments to MSME units were estimated over 4.95 lakh crore. The Central Government ministries and departments, state governments and public sector units owe MSMEs more than half of this amount. The MSME Samadhaan website, which was introduced to monitor delayed payments and settle disputes filed by affected MSMEs, listed payment claims of 40,720 crore as on May 14, 2020.

How to become a MSME?

Any existing functioning or new business set up fulfilling the eligibility criteria can apply for MSME registration through https://udyogaadhaar.gov.in, national portal for registration of MSME. Aadhar Card is compulsory in the registration of MSME.

FAQs

MSME covers only manufacturing and service industries. Trading companies are not covered by the scheme.

Leave A Comment