We all must have heard about Provident Fund under EPFO scheme under which 12% is deducted from our salary as employee deduction towards contribution to Provident Fund. Also there is further employer contribution of 12%. EPF is a retirement saving option, specially designed for salaried professionals and it is for a long term period. The contributed amount gets deposited at the EPFO (Employee Provident Fund Organization). As this is a long-term investment over the working years of an individual, a good amount of corpus gets accumulated, thereby making an individual financially independent after retirement.

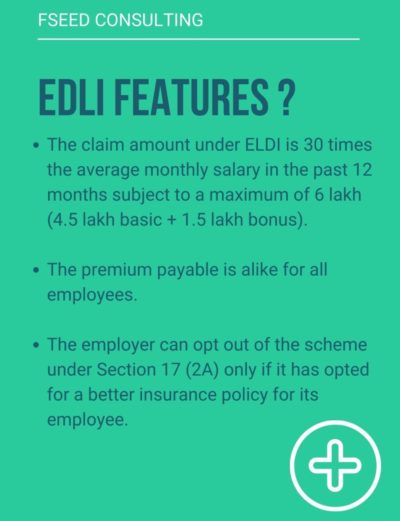

The government-run scheme is a savings scheme which is good for people who are looking for risk-free, guaranteed-return plans for retirement. EPFO offers three savings schemes to its subscribers, namely EPF, EPS and EDLI. The first two are savings schemes while Employee’s Deposit Linked Insurance Scheme (EDLI), as the name suggests, is an insurance scheme.

This is something what every employee pretty much knows. But what you don’t know is, if you’re paying PF then you’re by default covered under Employees Deposit Linked Insurance Scheme EDLI.

What is EDLI?

The EDLI scheme was launched in 1976, and is available to all employers who provide EPF provision to their employees. The scheme offers life insurance coverage to the employees.

How to subscribe to EDLI?

The scheme is linked to the EPF and EPS savings scheme. All the employees who subscribe to the EPF scheme automatically get enrolled in the EDLI scheme. There is no eligibility criteria of age or other individual factors for the EDLI scheme.

EDLI scheme contributions:

The contributions in the EDLI scheme are made indirectly by the employee. It is the employer who actually makes the contribution. The contributions to the scheme are made in accordance with a formula of a fixed percentage of DA and salary.

EDLI contribution by Employer: 0.50% (subject to a maximum of Rs.75)

Free Insurance you never heard about

How to claim EDLI amount?

- The benefits can be claimed by the nominee specified by the insured person.

- If no nominee was registered, then the family members or legal heirs can apply for the same.

- The deceased person should have been an active contributor to the EPF scheme at the time of his/her death.

- EDLI Form 5 IF has to be duly completed and submitted by the claimant.

- The claim form has to be signed and certified by the employer.

- If there is no employer or the signature of the employer cannot be obtained, the form must be attested by any of the following:

- Bank manager (in whose branch the account was maintained)

- Local MP or MLA

- Gazetted Officer

- Magistrate

- Member/Chairman/Secretary of Local Municipal Board

- Post Master or Sub-Postmaster

- Member of the regional committee of EPF or CBT

- The claimant must submit all the documents along with the completed form with the regional EPF Commissioner’s Office for processing of the claim.

- The claimant can also submit Form 20 (for EPF withdrawal claim) as well as Form 10C/D to claim all the benefits under the three schemes, EPF, EPS and EDLI)

- EPF commissioner must settle the claim within 30 days from the receipt of the claim. Otherwise, the claimant is entitled to interest @12% p.a. till the date of actual disbursal.

NOTE: The EDLI claim is only admissible if the deceased person was in active service at the time of death.

Process of Claim

Documents required for a claim under the EDLI scheme: These are the documents they need to submit along with the form-

- Duly Completed Form 5

- Death Certificate of the insured person.

- Succession Certificate in case the legal heir files the claim.

- Guardianship Certificate if the claim is filed on behalf of a minor by a person other than the natural guardian.

- Copy of cancelled cheque for the account in which the payment is to be received.

To know more about financial planning and how you can manage your legacy, kindly contact team Fseed.

Not much to add, other than thank you for expressing this so eloquently, and I agree with every point you raise. Emily Freddy Davina